POTENSI PELABURAN PERAK

Emas memang menjadi kesukaan ramai manusia sebagai perhiasan dan juga sebagai portfolio pelaburan yang menguntungkan dan selamat. Namun, ramai yang tidak mengetahui dan sedar prospek pelaburan perak. Public Gold menawarkan pelaburan perak pada harga yang mampu dibeli selain daripada jongkong perak

Pada 19 Julai 2012 , 10 dirham PG berharga RM114.00. Harganya meningkat kepada RM135.006/9/2012 .

Peningkatan sebanyak 15% dalam tempoh kurang 2 bulan. Semak harga sekarang klik

Spot Price siver semasa artikel ini ditulis ialah USD32.55/Oz. Spot price silver pernah mencapai USD48/Oz sekitar April 2011.

Harga tertinggi pernah dicatat adalah USD49.45 pada tahun 1980. Sebelum Hunt Brother menyebabkan kejatuhan harga yang teruk .

Metal: Ag

Weight (g): 29.75

Diameter (mm): 38

Thickness (mm): 2.96

Purity: 999

Di antara faktor yang menyumbang kepada kenaikan harga Perak.

- Silver and gold are traditionally known as a safe-haven investments to hedge market volatility and for protection against inflation. The U.S. dollar index has lost over 30% since 2002 and the fiscal gap is projected to exceed $63 trillion.

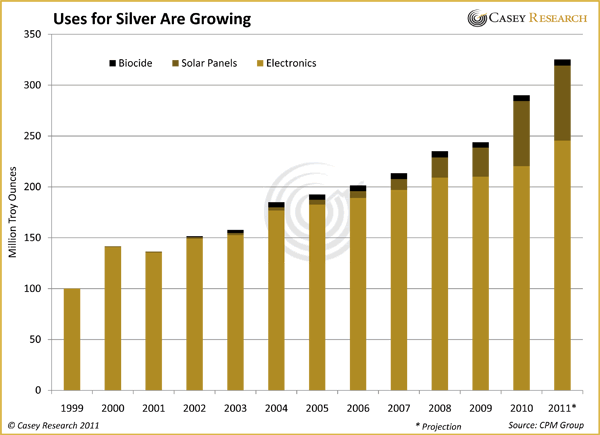

- Silver has more industrial uses than all other metals and is the best conductor of electricity and temperature. Computers, servers, monitors, cell phones, batteries, TVs, washing machines, superconductors, light switches, even refrigerators... almost all electronic devices require silver.

- According to the US Mint, "Many investment experts believe that adding silver to your portfolio may improve its performance. That's because the forces that determine silver's price usually differ from, and in many cases counter, the forces that determine the price of many financial assets. Investment advisors often suggest that this relationship may help to reduce portfolio volatility. .

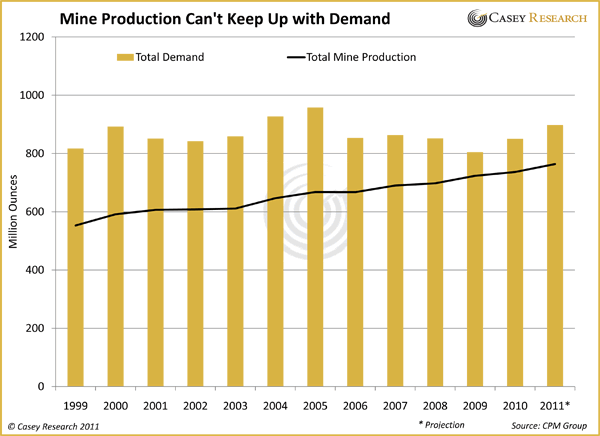

Not Enough Supply And Over Demand

- According to metal expert Luke Burgess, "Despite the lack of global stockpiles, new technology will continue to discover more industrial applications for silver, putting a further strain on world supplies." Right in line with this assertion, the Silver Institute predicts that silver demand for industrial purposes will increase by 36% by 2015.Industrial silver demand creates a greater sense of urgency than gold demand because it is needed rather than simply desired. Silver has been needed for decades, so it has been mined for decades in order to fulfill those needs.Silver is required in the production of products like CDs, cell phone batteries, calculators, printed circuit boards, hearing aids, electronic switches, TV screens, catalytic converters, inks, computer monitors, RFID chips, and thousands more.Nonetheless, silver is still very-much desired for its aesthetic value too. Burgess reported that 28% of jewelry suppliers saw silver sales increase by 25% from 2009 to 1010.

Meanwhile, the demand for silver for jewelry and investment is reaching record levels. A survey of 340 retail jewelers representing ~4,000 individual stores recently showed silver jewelry sales hitting record highs. The survey found:

- 87% of jewelry retailers said their silver jewelry sales increased in 2010

- 52% said their silver jewelry sales increased between 11% and 25%; 28% saw an increase over 25%

Retailers rated the following categories as giving them the “best” maintained margin:

- Silver jewelry 57%

- Diamond jewelry 20%

- Bridal jewelry 15%

- Gold jewelry 4%

- Platinum jewelry 4%

Jadi, jangan tunggu lagi.Pastikan perak samada dalam bentuk jongkong atau syiling sebagai portfolio pelaburan anda. Saya sendiri secara konsisten membeli 10 dirham setiap bulan.